Analysis of China’s DTH drilling bits cemented‑carbide market and production status

Within domestic drill‑tool manufacturers’ product lines, tooling for down‑the‑hole (DTH) drilling rigs has been one of the fastest‑growing categories aside from light‑machine drill tooling. Based on the compressed‑air operating pressure, DTH tooling is commonly divided into low‑pressure and medium‑to‑high‑pressure types. The DTH drilling bits that match these tools therefore have different performance requirements for their cemented‑carbide buttons depending on the working air pressure.

Cemented carbide for low‑pressure DTH bits Before 2003, annual production of low‑pressure DTH bits in China was roughly stable at 400,000–450,000 units. At that time, domestic stone‑quarrying practices were relatively traditional and demand for medium‑to‑deep blast‑hole drilling had not yet been fully released, so the market for low‑pressure DTH bits was steady but limited in scale.

In the second half of 2007, quarries in coastal provinces such as Jiangsu, Zhejiang, Fujian and Guangdong began adopting medium‑diameter blast holes for medium‑depth drilling and blasting to substantially increase stone production. That shift triggered an explosive rise in demand for 90 mm low‑pressure bits and CIR90‑type impactors. These sizes were chosen because they fit medium‑diameter blast‑hole construction requirements, improving output while keeping costs manageable.

As demand surged, many drill‑tool manufacturers moved into production of 90 mm low‑pressure DTH bits and output climbed rapidly. The rapid change in supply and demand also caused price volatility. To compete, many suppliers adopted price‑cutting strategies, compressing profit margins and intensifying market competition.

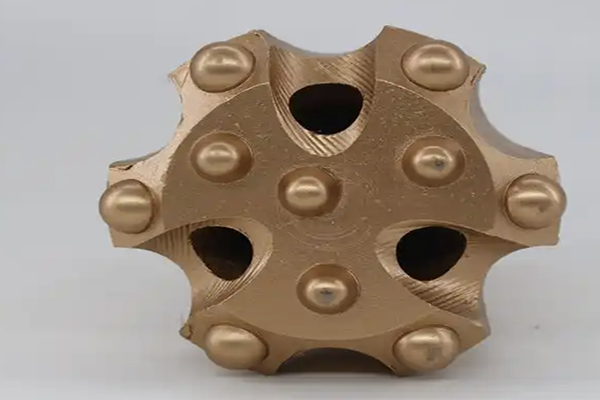

Today, annual production of low‑pressure DTH drill bits in China is around 3 million units, dominated by 90 mm diameter 9‑button and 10‑button bit designs. Typical cemented‑carbide consumption per bit is about 240 g, which corresponds to an annual carbide consumption of roughly 710 tonnes. Because low‑pressure bits experience relatively lower impact and wear during operation, the performance demands on the carbide buttons are not as strict. Coupled with fierce price competition, most manufacturers choose mid‑to‑low‑grade tungsten‑carbide powders to produce carbide buttons in order to reduce costs and stay competitive.

Cemented carbide for high‑pressure DTH bits In recent years, purchases of high‑pressure DTH rigs have steadily increased, driving clear growth in demand for high‑pressure DTH tooling (impactors operating around 1.5 MPa to 2.2 MPa). This reflects growing recognition of high‑pressure DTH systems in projects that require higher drilling efficiency and depth.

Rising market demand has led many manufacturers to shift production toward high‑pressure tooling. Given the steady year‑on‑year increase in high‑pressure rig sales, it is reasonable to expect continued growth in demand for high‑pressure DTH tooling over the next five years, and for high‑pressure products to gradually replace some of the low‑pressure market share.

Currently, annual output of high‑pressure DTH bits from domestic manufacturers is about 300,000–350,000 units, with diameters mainly in the 115–165 mm range; bits above 200 mm remain relatively rare. Typical tooth counts include 15, 16, 18 and 20 buttons. Cemented‑carbide usage per bit is close to 1 kg, giving an annual carbide consumption of around 300 tonnes.

From an impact‑energy perspective, high‑pressure bits must endure larger impacts and more severe wear, so the carbide buttons require higher performance. Historically, manufacturers used mid‑to‑high‑grade tungsten‑carbide powders to produce buttons that meet the hardness, wear resistance and impact toughness needed for high‑pressure operations.

However, with the increase in producers and tightening market competition, some manufacturers have recently switched to mid‑to‑low‑grade tungsten‑carbide powders to lower production costs and improve price competitiveness. While this reduces cost, it can adversely affect bit performance and service life, so the industry needs to monitor product‑quality stability closely.